Oil has entered a bear market by falling over 20%. If that means a global economic slowdown that's bad news for the I Fund, the C Fund and S Fund; Then again supply may have simply outpaced demand. Image: Mohammad Fahmi Abu Bakar/Shutterstock.com

By: Lyn Alden

Oil has entered a bear market by falling over 20%. If that means a global economic slowdown that's bad news for the I Fund, the C Fund and S Fund; Then again supply may have simply outpaced demand. Image: Mohammad Fahmi Abu Bakar/Shutterstock.com

By: Lyn AldenDuring the recent October sell-offs, the C Fund which tracks the S&P 500 was briefly in the red for the year, as it fell below its starting price for 2018. Due to the recent rally starting in the last few days of October, the C Fund is once again positive year-to-date, if only by a little:

Chart Source: Google Finance

The S Fund, which tracks the Dow Jones US Completion Total Stock Market Index, as well as the G Fund, are also above their 2018 starting prices as of this writing. The F Fund and I Fund, however, are still below where they started the year.

An Update on Moving Averages

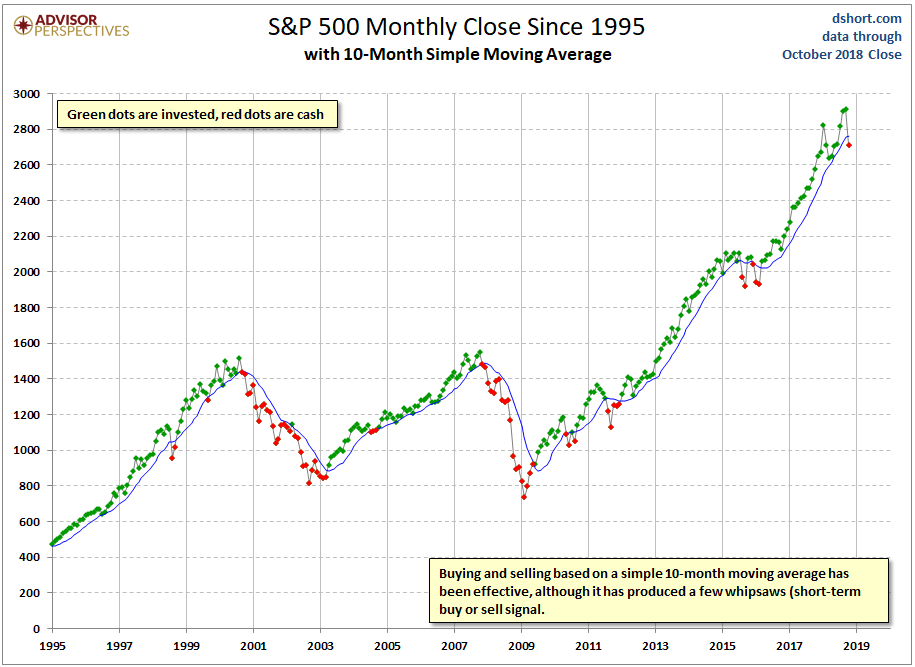

As I described in an article about capital preservation back in February 2018 during the previous market sell-off, some investors monitor moving averages to protect capital.

There are a variety of approaches, but the basic idea for the strategy is that whenever a fund falls below its 200-day or 10-month moving average, investors sell that fund and go to cash (or in the TSP’s case, the G Fund) and when it rises above its 200-day or 10-month moving average once again, investors buy back in.

It’s not an approach I use personally, but the method in general is evidenced with decades of back-testing to give slightly better returns and significantly lower volatility than a typical buy-and-hold strategy. It tends to help investors avoid the worst declines from the big bear markets, but requires hands-on activity and is therefore subject to error. And, past results don’t come with any guarantee that a strategy will continue to work as intended in the future.

October closed with the S&P 500 below its 10-month moving average (red on the chart below), which hasn’t happened since early 2016:

However, as of early November the S&P 500 is back up above its more frequently-updated 200-day moving average. The S Fund is still below its 200-day moving average, and so is the I Fund.

The Price of Oil Recently Crashed

After a choppy move upward for most of 2018, the price of oil crashed into a bear market over the past month:

Chart Source: Oilprice.com

From a peak of over $76/barrel in the beginning of October to just over $60/barrel in mid-November, the price of oil has fallen by just over 20%, which officially puts it in a bear market.

Some investors take this as a sign of a global economic slowdown. When economies weaken, oil demand tends to decrease, which is bearish for the price of oil as long as supply stays intact. If that’s the case, it’s not good news for the I Fund, and not great news for the C Fund or S Fund either.

However, another possibility is simply that supply has outpaced demand. Several countries have been given temporary waivers to continue buying Iranian oil despite U.S. sanctions, so the supply from that country hasn’t left the market as quickly as some oil analysts may have anticipated.

The cause of the decline aside, low oil prices are good news for consumers and most companies. It means cheaper gasoline, which gives consumers more discretionary spending on other parts of the economy. It also means lower manufacturing and transportation costs for various products as well as lower inflation, all else being equal.

Lyn Alden is a financial writer and an engineer, and holds a bachelor’s in engineering and a master’s in engineering management, with a focus on financial modeling and resource management. She specializes in analyzing and presenting financial data. Her investment work can be found on LynAlden.com.