A question on many analysts’ minds is whether a recession is in the cards for many countries in the 2020-timeframe, or if this is yet another slowdown that will resume into another mini-cycle of growth. Image: leungchopan/Shutterstock.com

By: Lyn Alden

A question on many analysts’ minds is whether a recession is in the cards for many countries in the 2020-timeframe, or if this is yet another slowdown that will resume into another mini-cycle of growth. Image: leungchopan/Shutterstock.com

By: Lyn AldenThe week that included July 4th was a shortened trading week, but the S&P 500 (which the C Fund tracks) touched new record highs. It is now just 0.3% away from reaching the 3,000 mark for the first time in history, which although arbitrary, would be a big new milestone for the index.

Chart Source: Google Finance

This week, the Bureau of Labor and Statistics released the June jobs report, which surprised to the upside. Consensus analysts were expecting 160,000 jobs created, but the number came in at 224,000. There is a lot of error in these reports, and year-over-year job growth remains in a mild decline, but these numbers were solid.

CNBC often does a good breakdown of where the jobs are coming from and going to in each month:

Chart Source: CNBC

The big gainers continue to be education, health, and professional services. Government had a net job creation of 33,000. Transportation and warehousing (which benefits from the growth of online retail) also did well.

Mining performed poorly, and the retail industry continued to suffer.

Discount retailers including Walmart, Costco, and Dollar General are doing very well, and their stocks are at record highs. Target’s stock is also near record highs. Retailers that are tied to malls have done very poorly. Macy’s stock, which was trading as high as $70/share in 2015 and $40/share in 2018, is now down to $22/share. Just eight months ago, Nordstrom’s stock was at $67/share, and now it’s sitting at half that value at $32/share.

Lowe’s and Home Depot are doing quite well, but their stocks are modestly off their 2018 highs due to a weaker housing market. Most of these companies are in the C Fund.

Slowing Global Growth

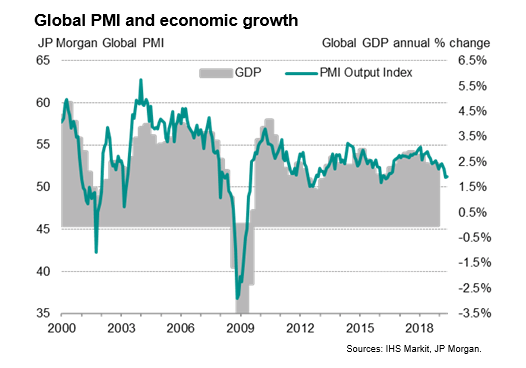

The composite purchasing manager’s index (PMI) continues to deteriorate, and global GDP growth rates have been on the decline:

Chart Source: HIS Market, JP Morgan

In the decade-long worldwide business growth cycle since the end of the global financial crisis, we can see three distinct periods of economic slowdown, or mini-cycles. These affected the United States as well as the rest of the world to various degrees. None of these turned into recessions, but instead were periods where the rate of growth declined, and stock markets generally did poorly.

The first slowdown occurred in 2012 during the height of the European sovereign debt crisis where several European countries like Greece, Portugal, Ireland, Spain, and Italy ran into trouble due to high government debt and spiraling government bond yields.

The second slowdown occurred in 2016, in part caused by a drastic reduction in the price of oil and other commodities. China’s growth rate and demand for commodities declined, and some commodity-producing countries, notably Brazil and Russia, fell into recession. OPEC tried to pump oil and lower the price of oil as much as possible to bankrupt the growing U.S. shale oil industry so that OPEC could maintain market share in the aftermath, but that strategy ended up not working.

Now we are in a third slowdown, in part attributed to global trade concerns. In the United States, the big initial effects from the 2018 tax cuts have partially worn off, the trade dispute between the United States and China has cast uncertainty on global supply chains and capital spending, and China has been trying to deleverage its extremely high corporate debt levels. Separately, Europe continues to experience slow growth related to high debt levels and uncertainty over Britain’s upcoming exit from the European Union. A long period of zero interest rates in Europe have been hurting their banking sector as well.

A question on many analysts’ minds is whether this will lead to a recession for many countries in the 2020-timeframe, or if this is yet another slowdown that will resume into another mini-cycle of growth.