Start the process now so you pay less in interest and get your records squared away well before retirement. Image: RODWORKS/Shutterstock.com

By: Dallen Haws

Start the process now so you pay less in interest and get your records squared away well before retirement. Image: RODWORKS/Shutterstock.com

By: Dallen HawsMilitary time can be worth a lot if you are now a civilian FERS federal employee.

But the devil is in the details.

You have to pay a deposit to apply your military time to your federal service and it isn’t worth it for all military veterans.

Buying Back Your Military Time

The common phrase used for making your military time count towards your civilian career is called “buying back” your time.

But this process isn’t free. You have to pay a deposit to make this happen.

However, it is very much worth it for most veterans who are now federal employees.

Note: The one situation where 90% of the time it does not make sense to buy back time is when you have a military pension. But if you don’t have a military retirement then you’ll want to buy back your time 99% of the time.

What Bought Back Time Gets You

Buying back your time gets you more creditable years of service which has 2 major benefits:

1. You are often eligible to retire earlier

2. Your pension will be bigger

How Much Does it Cost?

The cost to buy back your time will be based on your military base pay and when you served.

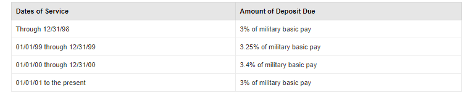

The chart below shows the percentage of your basic pay that you’d have to pay to buy back your time during different years.

For most years, it will be 3% for FERS employees.

Here is the formula to calculate your military deposit (aka, what it costs to buy back your military time).

Total Military Basic Pay x 3%* = Cost to Buy Back Time (before interest)

*This will be higher than 3% for time between 1999-2000. See chart above.

So basically you need to add up every year’s basic pay and multiply that by 3%.

Example:

Let’s say you had 4 years of service back in the early 90’s and had the following basic pay during those years:

1990: $13,000

1991: $14,000

1992: $16,000

1993: $18,000

Total Basic Pay: $61,000

This means that it would cost the following to buy back these 4 years before interest.

$61,000 x 3% = $1,830 (before interest)

Interest!!

But we are not out of the woods yet.

Most federal employees will also have to pay interest on their deposit as well. The interest rate is different every year, but as you can imagine, the longer you wait to buy back your military time, the more it is going to cost you.

Interest Exception

The government offers a 2-year grace period from the day you started your civilian job to pay back your time without interest accruing. But because interest doesn’t start to accrue for a year after the grace period, in practice you actually have a 3 year grace period.

So if you pay your deposit within 3 years of starting your civilian career you won’t owe any interest.

But even if you are already passed the grace period, it often still makes a ton of sense to buy back even with interest.

Still Worth It

While it does cost money to buy back your time it will increase your civilian pension for the rest of your life.

Most people recoup the cost of buying back their time with just a couple years of retirement.

1st Step to Buy Back Your Time

The first thing to do is to talk to your HR about buying back your time. They will get you pointed in the right direction.

Your HR will help you request your military records so that they can get an estimate for what it would cost you.

You can pay the deposit in a lump sum or over time via payroll deductions.

What about Reserve or Academy Time?

You can buy back academy time and 99% of people should.

However, reserve or national guard time can only be back back if you were activated. And only the active duty time would be buyable.

Take Action!

Buying back your military time takes time!! As you know, most things in the government are slow and this is not an exception.

Also, you can’t buy back your time after you retire. It has to happen while employed as a civilian federal employee.

So start the process now so you pay less in interest and get your records squared away well before retirement.

Dallen Haws is a Financial Advisor who is dedicated to helping federal employees live their best life and plan an incredible retirement. He hosts a podcast and YouTube channel all about federal benefits and retirement. You can learn more about him at Haws Federal Advisors.

Trump to move Space Command headquarters out of Colorado

National Guard Order Calls for Hiring More Fed LEOs, Military Unit Under Interior, DHS, Justice

Audit: Rise in ‘Severe Staffing Shortages’ at VA Medical Facilities

Marines Seek New Boots on the Ground

Can My Military Discharge be Upgraded? Yes

The Rules for Getting Both Military Retired Pay and a Federal Annuity

Credit for Military Service for Federal Retirement Annuities