FRA is the age after which you are able to collect full Social Security benefits without penalty for collecting pre-FRA. Image: Steve Heap/Shutterstock.com

By: Lacie Harmon, The Federal Benefits Group

FRA is the age after which you are able to collect full Social Security benefits without penalty for collecting pre-FRA. Image: Steve Heap/Shutterstock.com

By: Lacie Harmon, The Federal Benefits GroupYour Social Security Full Retirement Age (FRA) is an age set by Social Security, and it varies based on your year of birth. For those of us born between 1938 and 1942, it’s 65 and often some additional months, for those born between 1943 and 1959, it’s 66 and often some additional months. For those born 1960 or later, that age is 67.

FRA is an important thing to understand for two reasons. First, it’s the age after which you are able to collect full Social Security benefits without penalty for collecting pre-FRA. Second, it’s the age at which you are able to earn unlimited income and also collect Social Security without any penalty.

If you haven’t reached your FRA, the following rules apply for 2025:

You can earn up to $23,400 without penalty to your benefit.

In the event you’re retiring some time during 2025, the rules are relaxed and your limits on earnings don’t begin until after you’ve retired. At that time, as long as you don’t exceed earnings of $1,950/mth. or perform “substantial services” while self-employed, no penalties are applied to your Social Security benefit. Amounts over that will be penalized $1 for every $2 that you earn over the limit. (Please note, the aforementioned rules also apply to the Social Security Special Supplement, which is the secondary pension paid out to federal retirees under age 62 who have met the age and service requirements).

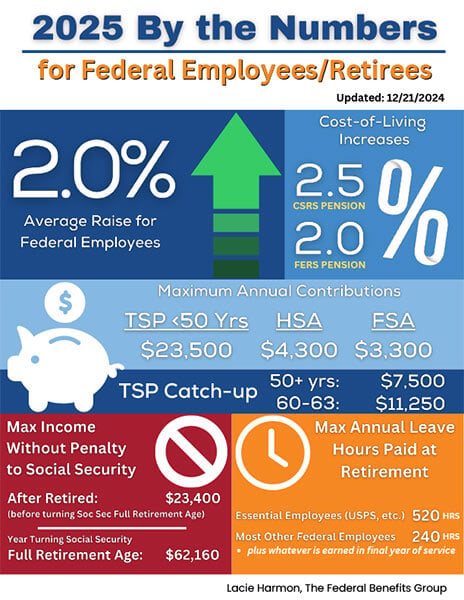

Below is a handy infographic designed to help you in making sound financial decisions about your benefits and retirement in 2025:

If you’ll be reaching your FRA in 2025, as you can see on the graphic, you’re permitted to earn $62,160 without penalty in the months before reaching your FRA. Earning amounts over this will result in a penalty of $1 for every $3 that you earn over the limit. But, once you’ve reached your FRA month, voila: all earnings limits and penalties fall away.

Please note that all income referred to on the chart applies to “earned income” only. This means income from working a job, and does not include pension (annuity), capital gains, rental property, or any other type of income.

A happy, healthy and prosperous 2025 to you and yours!

Lacie Harmon is a Federal Benefits and Retirement Specialist who helps federal employees understand and maximize their benefits, both during employment and retirement years. She teaches regularly at federal agencies and offers monthly federal retirement webinars. Past classes taught include for clients such as the FAA, USDA and GAO, as well as union locals of the APWU and NALC. Web: https://www.lacieharmon.com | Facebook: https://www.facebook.com/FedRetirementHelp | Email: LHarmon@thefederalbenefitsgroup.com

Key Bills Advancing, but No Path to Avoid Shutdown Apparent

TSP Adds Detail to Upcoming Roth Conversion Feature

White House to Issue Rules on RIF, Disciplinary Policy Changes

See also,

Legal: How to Challenge a Federal Reduction in Force (RIF) in 2025

The Best Ages for Federal Employees to Retire

Alternative Federal Retirement Options; With Chart

Primer: Early out, buyout, reduction in force (RIF)

Retention Standing, ‘Bump and Retreat’ and More: Report Outlines RIF Process