DeJoy: conditions have added an estimated 6 billion dollars of unplanned cost in 2023. Image: pio3/Shutterstock.com

By: Paul Steidler, Lexington Institute

DeJoy: conditions have added an estimated 6 billion dollars of unplanned cost in 2023. Image: pio3/Shutterstock.com

By: Paul Steidler, Lexington InstituteOn August 8, the U.S. Postal Service (USPS) announced another large, predictable financial loss of $1.7 billion for its third quarter ended June 30, and $5.2 billion for year-to-date. This was supposed to be the year USPS broke even or was even modestly profitable after Congress provided $107 billion in assistance through the 2022 Postal Service Reform Act.

While there have been several positive developments at USPS recently, the organization is caught in a downward spiral, with volume plummeting, revenue down, and losses rising even though the economy is growing. When and if the financials are going to be turned around was not made clear at the August 8 public meeting where the third-quarter performance was announced.

Congress needs to get back at it re: Postal Reform and should do so before USPS runs out of cash, which could be in less than three years. Here is a snapshot of key items from the August 8 announcements.

Good – Service Performance

As it did with election mail in 2022 and other years, USPS delivered mail and packages in a timely fashion in the third quarter. Nearly 93 percent of first-class mail was delivered on time (i.e., met the service standard). 98 percent of the nation’s population received their mail and packages in less than three days.

Good – Network Improvements

USPS’s network realignment continues to proceed briskly, an ambitious plan by Postmaster General DeJoy to modernize and improve USPS’s physical infrastructure. Over the next 17 months, USPS plans to open nine regional centers as well as renovate 27 local processing centers and 60 additional sorting and delivery centers. Approximately 85% of next year’s investment will be allocated towards existing USPS facilities.

Bad – Plummeting Volume

Volume dropped precipitously at USPS in the third quarter. The magnitude of the fall, and the fact that mail seldom returns to the postal system after it leaves, should be setting off alarm bells for USPS to re-assess, and take a strategic pause on aggressive price increases on mail products, which exceed the rate of inflation. USPS cannot afford to lose these customers.

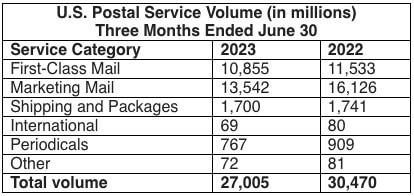

As seen in the chart below, from the August 8 USPS press release, volume was down in all service categories and 11.4 percent overall. Marketing mail was hit especially hard, falling 16 percent.

Bad – Declining Revenues

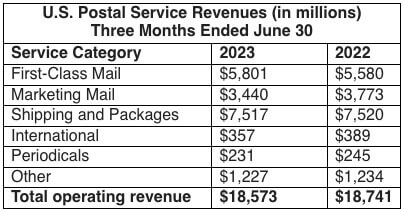

As also stated in the press release, USPS had declining revenues in all service areas except for one: first-class mail.

This occurred despite the U.S. economy having more than two percent growth in annualized Real Gross Domestic Product between October 1, 2022 and June 30, 2023. Furthermore inflation, to which USPS attributes many of its challenges, had cooled during this period.

On July 12, the Bureau of Labor Statistics announced that the “all items index increased 3.0 percent for the 12 months ending June 30; this was the smallest 12-month increase since the period ending March 2021.” Additionally, gasoline prices declined 26.5 percent for the 12 months ending June 30, 2023. This is notable given USPS’s large fuel expenses.

The To-Be-Determined Push for Congressional Reforms

In his August 8 remarks on the challenges facing USPS, Postmaster General DeJoy said: “conditions have added an estimated 6 billion dollars of unplanned cost in 2023 alone and will be in our operating cost base well into the future.”

Whether or not these costs could and should have been anticipated, the Postmaster General’s remarks point to the enormous financial challenges facing USPS for years to come.

A key reason is that USPS must invest its nearly $300 billion in pension and retiree health care funds into solely low-interest government bonds. Roman Martinez, Chairman of USPS’s Board of Governors, has been calling attention to an April 26 report by the USPS Office of Inspector General that shows the Postal Service would have $1 trillion more in retirement assets had it invested these funds as state pensions do for government workers. That is, in a diversified mix of plain vanilla stocks and bonds.

Such an approach would enable USPS, over time, to gain at least two percent more on its $300 billion in assets and curtail the effects of the $6 billion in increased annual costs.

This central reform should have been part of Congress’s reform package in 2022. Otherwise, it is inordinately difficult for USPS to operate without large losses, even in the best of economic times.

USPS should petition Congress immediately for additional reforms. In addition to gaining a diversified investment approach, USPS should institute a modern pricing system, so it can know how profitable, or not, various products are and can adjust prices accordingly. Congress should either define the Universal Service Obligation (USO) or it should empower the Postal Regulatory Commission to initiate a process to define the USO.

Also, USPS should petition Congress soon for these operational policy changes which do not require additional financial assistance. Congress has provided USPS with more than $120 billion in assistance in the last two years. If USPS waits to make additional asks in a few years, Congress may be more inclined to make more far-reaching, radical changes to USPS.

About the Author: Paul Steidler is a Senior Fellow with the Lexington Institute, a public policy think tank based in Arlington, Virginia.

Large Share of Federal Workforce about to Experience a Payless Pay Period

OPM Details Coverage Changes, Plan Dropouts for FEHB/PSHB in 2026

OMB Says Federal Workforce RIFs are Starting as Shutdown Drags On

Financial Impact of Shutdown Starts to Hit Home; WH Threatens No Back Pay

Surge of Retirement Applications Is in the Pipeline, Says OPM

See also,

TSP Takes Step toward Upcoming In-Plan Roth Conversions

5 Steps to Protect Your Federal Job During the Shutdown

Over 30K TSP Accounts Have Crossed the Million Mark in 2025

The Best Ages for Federal Employees to Retire