It's not a bad time to assess your asset allocation - not in a reactionary way, but take your own pulse in the face of recent volatility. Image: FEDweek

By: FEDweek Staff

It's not a bad time to assess your asset allocation - not in a reactionary way, but take your own pulse in the face of recent volatility. Image: FEDweek

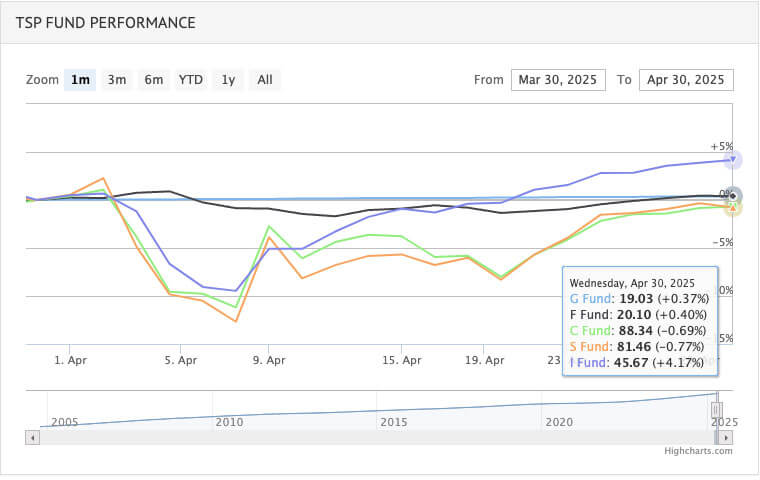

By: FEDweek StaffThe TSP’s C fund of large U.S. companies and the S fund of medium and smaller U.S. companies continued to fall in April, down 0.68 and 0.78 percent on the month and down 4.93 percent and 9.65 percent year-to-date.

The other stock-based fund, the I fund of international stocks, meanwhile continued to rise, up 4.16 percent for the month and an even 9 percent for the year.

The bond F fund gained 0.39 percent in April and the government securities G fund gained 0.35 percent, for year-to-date gains of 3.18 and 1.48 percent.

The April returns for the lifecycle L funds were: Income, 0.67; 2025, 0.68; 2030, 0.92; 2035, 0.05; 2040, 0.97; 2045, 0.99; 2050, 1; 2055, 2060, 2065, 2070, 1.01. Their year-to-date results range from 1.13 percent to -0.82 percent.

In other TSP news: In-plan Roth conversions are coming ton the TSP, the board hopes to begin offering them next January.

And some perspective on recent market volatility from Abe Grungold in TSP and Fire Sale Buying Opportunities:

During the history of the TSP, there have been many times to invest when the stock market has taken a dip. That dip could be anywhere from 10 percent to 40 percent. Those time periods were the Dot.com era, (2000), Financial Crisis of 2008-2009, COVID 2020 and the Ukrainian Crisis 2022. Each time the market dropped it came back higher than before. When the market goes up and down, every pay period you are purchasing units of your TSP at different prices points. These purchases are called dollar cost averaging investing.

It’s not a bad time to assess your asset allocation. Tyler Weerden asks “Is Yours Still a Fit?”

With some recent market volatility, now is a good time to reassess whether your current mix of stocks, bonds, and cash still fits your personal situation. This doesn’t mean a major overhaul or an emotional, reactive decision. Instead, take a moment to ask yourself: How do I feel about my current investment setup?

Large Share of Federal Workforce about to Experience a Payless Pay Period

OPM Details Coverage Changes, Plan Dropouts for FEHB/PSHB in 2026

OMB Says Federal Workforce RIFs are Starting as Shutdown Drags On

Financial Impact of Shutdown Starts to Hit Home; WH Threatens No Back Pay

Surge of Retirement Applications Is in the Pipeline, Says OPM

See also,

TSP Takes Step toward Upcoming In-Plan Roth Conversions

5 Steps to Protect Your Federal Job During the Shutdown

Over 30K TSP Accounts Have Crossed the Million Mark in 2025

The Best Ages for Federal Employees to Retire