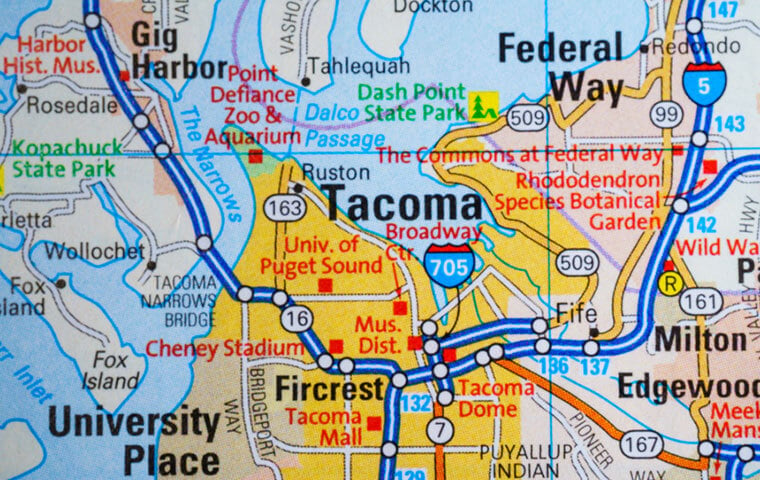

Seattle-Tacoma has the highest locality pay rate at 5.7 percent. The bill It expressed cost-of-living challenges due to unique local housing market dynamics that affect the cost of housing. Image: Alexander Lukatskiy/Shutterstock.com

By: FEDweek Staff

Seattle-Tacoma has the highest locality pay rate at 5.7 percent. The bill It expressed cost-of-living challenges due to unique local housing market dynamics that affect the cost of housing. Image: Alexander Lukatskiy/Shutterstock.com

By: FEDweek StaffThe DoD authorization bill now ready for a Senate vote addresses several federal employment-related issues, including ordering a review of locality pay rates.

The Senate Armed Services Committee earlier had released only a summary of the bill which showed that the bill assumes a 2 percent federal employee raise in January; would raise the maximum buyout payment at DoD from $25,000 to $40,000; and would make permanent a special hiring authority for spouses of military personnel.

More detailed report language issued to prepare the bill for floor voting shows that the measure also would require DoD to report to the committee on whether locality pay rates for its civilian employees—as well as housing rates for military personnel—“may negatively impact readiness, recruitment, and retention of uniformed and civilian employees in highly specialized, technical, and scientific fields.”

It expressed special concern about “installations located in certain real estate markets with higher shares of single-family housing and seasonal population swings that drive higher housing costs.”

Civilian and military personnel in such high cost areas “face significant cost-of-living challenges due to unique local housing market dynamics that affect the cost of housing. These factors include significant seasonal population changes and the high prevalence of second homes,” it says.

Locality pay rates at DoD are the same as at other agencies; a review there would carry implications for the locality pay program in general.

The bill further would freeze employment at the department in positions related to DEI initiatives and prevent filling any vacancies in related positions—stopping short of language in several House bills to end such initiatives government-wide.

It further would continue several special pay authorities for civilians assigned to areas of military operations or in certain occupations, and would continue or expand flexible hiring rules in certain subagencies and occupations.

Senate Eyes Vote to Pay Federal Employees Working Unpaid

Series of Bills Offered to Address Shutdown’s Impact on Employees

Public Starting to Feel Impact of Shutdown, Survey Shows

OPM Details Coverage Changes, Plan Dropouts for FEHB/PSHB in 2026

Does My FEHB/PSHB Plan Stack Up? Here’s How to Tell

2025 TSP Rollercoaster and the G Fund Merry-go-Round

See also,

TSP Takes Step toward Upcoming In-Plan Roth Conversions

5 Steps to Protect Your Federal Job During the Shutdown

Over 30K TSP Accounts Have Crossed the Million Mark in 2025