Image: FEDweek

By: FEDweek Staff

Image: FEDweek

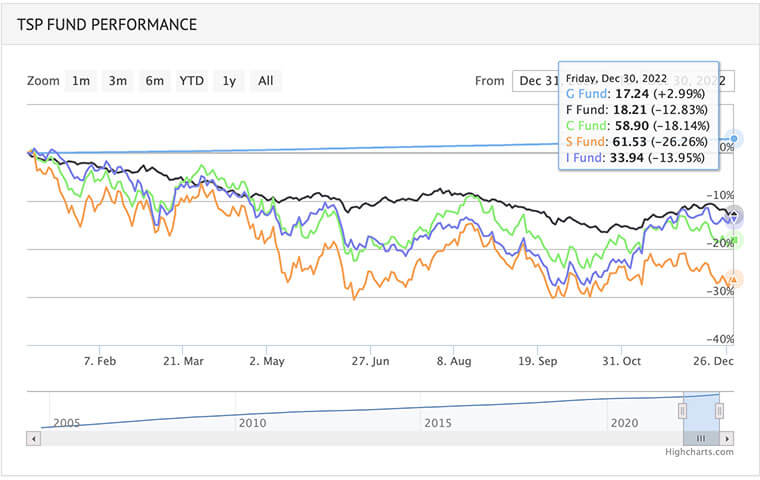

By: FEDweek StaffThe TSP stock-based funds in 2022 posted their worst year since 2008, with the small company stock S fund down 26.26 percent, the large company stock C fund down 18.13 percent and the international stock I fund down 13.94 percent.

The bond F fund was down 12.83 percent, while the ever-gaining government securities G fund rose 2.98 percent for the year.

Losses in underlying funds also dragged all of the lifecycle L funds into negative territory for the year. Their 2022 returns were: Income, -2.7; 2025, -6.72; 2030, -10.32; 2035, -11.65; 2040, -12.9; 2045, -14.03; 2050, -15.05; 2055, -17.6; 2060, -17.61; 2065, -17.62.

Change in Direction on Employee Issues Ahead in New Congress

Early House Actions to Reflect GOP Focus on Spending

House Republicans Move to Revive Rule for Targeting Individual Federal Employees

January Raise Finalized, Will Range from 4.37 to 5.15 Percent

Spending Bill Allows 4.6 Percent Raise; Doesn’t Prevent a Future Schedule F

Most Expansion of GS Localities Put Off Until 2024; 2023 Raises Announced

See also,

OPM Describes Impact of Raise on Differing Categories of Employees

Oversight of Federal Employment, Retirement Issues Ahead

The TSP 2022 Website and Unresolved Issues

The Process of Retiring: Check Your Agency’s Work