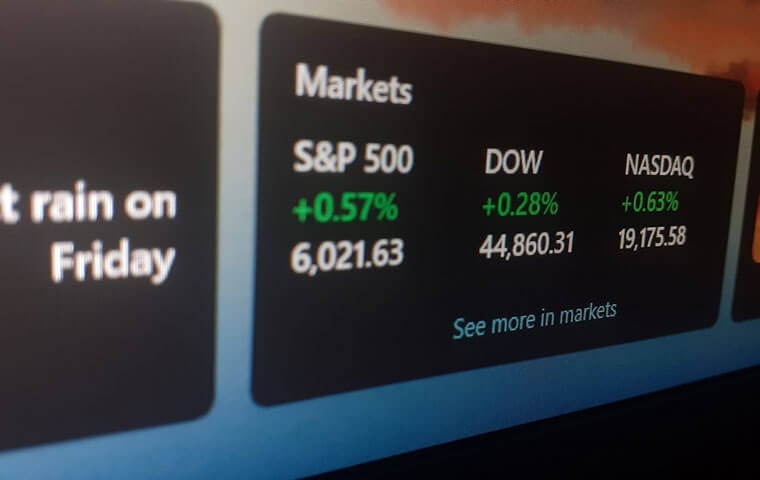

Major market indexes have recovered losses from earlier in the year, with the C Fund - tracking the S&P 500 - setting new record highs. Image: Nwz / Shutterstock.com

By: FEDweek Staff

Major market indexes have recovered losses from earlier in the year, with the C Fund - tracking the S&P 500 - setting new record highs. Image: Nwz / Shutterstock.com

By: FEDweek StaffThe TSP passed the $1 trillion mark in account balances for the first time in June, hitting $1.006 trillion, due largely to gains that month in the stock-based funds.

While the growth last month was not particularly notable at $31 billion, crossing the $1 trillion figure underscores the importance of the program to current and former federal employees and military personnel and survivors. There are now some 7.245 million account holders.

The average balance for an investor under the FERS system—currently employed or separated—meanwhile crossed $200,000 in June, finishing at just under $203,000, while the average account balance for one under the CSRS system stands at just under $229,000. Each is up by about $9,000 year-to-date.

The TSP had approached the $1 trillion mark with $985 billion as of the end of January but then fell back to as low as $937 billion at the end of March before rebounding.

TSP total asset counts are largely driven by performance of the large company stock C, small and mid-sized company stock S and international stock I funds, which gained 5.08, 5.4 and 3.73 percent in June. Including their shares in the lifecycle L funds, those three funds account for 42.8, 10.9 and 10.5 percent of the total, according to figures released at the July meeting of the TSP governing board. The government securities G fund and the bond F fund account for 32 and 3.7 percent.

Looked at another way, the L funds collectively hold 25.2 percent of assets, while individual investments in the C, S, I, G and F funds account for the remaining 34, 8.7, 4.7, 25 and 2.2 percent.

Starting last year, money taken out through withdrawals and loans has outpaced new investments and loan repayments, a trend that has continued this year with a net outflow year to date of $8.4 billion.

Key Bills Advancing, but No Path to Avoid Shutdown Apparent

TSP Adds Detail to Upcoming Roth Conversion Feature

White House to Issue Rules on RIF, Disciplinary Policy Changes

DoD Announces Civilian Volunteer Detail in Support of Immigration Enforcement

See also,

How Do Age and Years of Service Impact My Federal Retirement

The Best Ages for Federal Employees to Retire

How to Challenge a Federal Reduction in Force (RIF) in 2025

Should I be Shooting for a $1M TSP Balance? Depends…

FERS Retirement Guide 2025 – Your Roadmap to Maximizing Federal Retirement Benefits