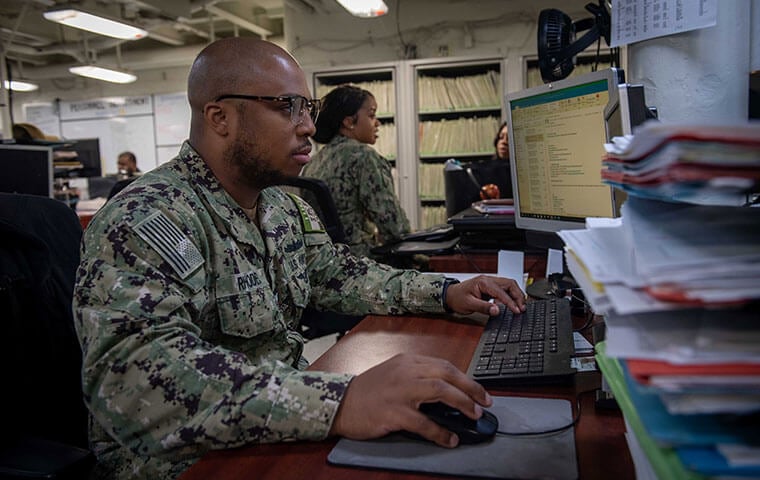

Norfolk VA - May 15, 2023: Personnel Specialist 2nd Class Daniel Rhodes, from St. Louis, processes a DD-214 form aboard the Nimitz-class aircraft carrier USS Dwight D. Eisenhower (CVN 69) while pier side in Naval Station Norfolk conducting routine maintenance. Image: Navy photo by MCS 3rd Class Rodrigo Caldas

By: FEDweek Staff

Norfolk VA - May 15, 2023: Personnel Specialist 2nd Class Daniel Rhodes, from St. Louis, processes a DD-214 form aboard the Nimitz-class aircraft carrier USS Dwight D. Eisenhower (CVN 69) while pier side in Naval Station Norfolk conducting routine maintenance. Image: Navy photo by MCS 3rd Class Rodrigo Caldas

By: FEDweek StaffFollowing is the section of OPM guidance on how veteran’s preference—which is mostly thought of in the context of hiring in the federal government—applies during reductions in force.

General Eligibility for Veterans’ Preference in RIF. Except for an employee who is a retired member of the Armed Forces, an employee who is eligible for veterans’ preference for purposes of initial appointment to the Federal service is also eligible for veterans’ preference under the RIF regulations. See “Veterans’ Preference in RIF When the Employee is Retired From a Uniformed Service” below for additional information.

In making an official determination of whether an employee is entitled to veterans’ preference for retention, or to determine whether an employee’s service in the Armed Forces is creditable for retention, refer to OPM’s VetGuide, which is available on the OPM website at www.opm.gov.

An agency has no authority to apply a “freeze” and restrict an employee from updating veterans’ preference records prior to the effective date of a RIF. An agency is not required to consider veterans’ preference records that are not available until after the effective date of the RIF.

Tenure Subgroups. The RIF regulations define three tenure subgroups. Within each of the three tenure groups on a retention register, the agency places the names of competing employees in veterans’ preference tenure subgroups. The same tenure subgroups are used for positions filled under competitive and excepted appointments.

1. Subgroup AD includes each veterans’ preference-eligible employee who has a compensable service-connected disability of 30 percent or more.

2. Subgroup A includes each veterans’ preference-eligible employee not in subgroup AD, including all employees eligible for “derivative preference” under section 2108(3)(D)-(G) of title 5, United States Code. 3. Subgroup B includes each employee not eligible for veterans’ preference under the RIF regulations.

Derivative Preference in RIF. Veterans’ preference also extends to four types of employees who are eligible for derivative preference, and who are therefore in retention subgroup A:

1. The unmarried widow or widower of a veteran, as “veteran” is defined in section 2108(1)(A) of title 5, United States Code (5 U.S.C. 2108(3)(D));

2. The spouse of a service-connected disabled veteran, as “disabled veteran” is defined in section 2108(2) of title 5, United States Code, who has been unable to qualify for a Federal position (5 U.S.C. 2108(3)(E));

3. The mother of a veteran (as “veteran” is defined in section 2108(1)(A) of title 5, United States Code) who died in a war or campaign, provided that the mother also meets other statutory conditions covered in section 2108(3)(F) of title 5, United States Code (5 U.S.C. 2108(3)(F)); or

4. The mother of a permanently disabled veteran (as “disabled veteran” is defined in section 2108(2) of title 5, United States Code), provided that the mother also meets other statutory conditions covered in section 2108(3)(G) of title 5, United States Code (5 U.S.C. 2108(3)(G)).

There is no authority to place an employee in retention subgroup AD on the basis of derivative preference.

Veterans’ Preference in RIF When the Employee is Retired From a Uniformed Service. The law limits veterans’ preference for retired members of a uniformed service to an employee who meets one of the following two conditions:

1. The employee’s retirement from a uniformed service without regard to benefits from the Department of Veterans Affairs is based on a disability that either:

- Resulted from injury or disease received in the line of duty as a direct result of armed conflict, or

- Was caused by an instrumentality of war, and was incurred in the line of duty during a period of war as defined by sections 101 and 301 of title 38, United States Code;

2. The employee’s retirement from a uniformed service is based on less than 20 years of full-time active service, excluding periods of active duty for training, regardless of when performed, and either:

- Retired at the rank of major (or equivalent) or higher, and is a disabled veteran, as defined in section 2108(2) of title 5, United States Code; or

- Retired below the rank of major (or equivalent).

The restrictions on veterans’ preference for RIF also apply to early retirement from the Armed Forces under Public Law 102-484 based upon a minimum of 15 (rather than 20) years of active military service.

Veterans’ Preference in RIF When the Employee is Retired From the Armed Forces as a Reservist. A veteran who becomes eligible for retired pay at age 60 as a reservist is not subject to the same restrictions on preference because the retirement from the Armed Forces is based on less than 20 years of creditable active service. If the employee otherwise meets the requirements for veterans’ preference, the reservist is eligible for veterans’ preference in RIF until age 60 when the Armed Forces retirement pay commences.

To retain RIF preference at age 60, the reservist must have either:

1. Retired at the rank of major (or equivalent) or higher, and be a “disabled veteran,” as defined in section 2108(2) of title 5, United States Code; or

2. Retired below the rank of major (or equivalent).

Key Bills Advancing, but No Path to Avoid Shutdown Apparent

TSP Adds Detail to Upcoming Roth Conversion Feature

White House to Issue Rules on RIF, Disciplinary Policy Changes

See also,

Legal: How to Challenge a Federal Reduction in Force (RIF) in 2025

The Best Ages for Federal Employees to Retire

Alternative Federal Retirement Options; With Chart

Primer: Early out, buyout, reduction in force (RIF)

Retention Standing, ‘Bump and Retreat’ and More: Report Outlines RIF Process