Steps to Take in the Run-Up to Retirement

A successful retirement requires careful, long-term planning. Your responsibilities begin with signing up for a pre-retirement counseling seminar. Your agency …More

A successful retirement requires careful, long-term planning. Your responsibilities begin with signing up for a pre-retirement counseling seminar. Your agency …More

A power of attorney can be invaluable. For example, you might suffer a stroke with no warning signals and be …More

Both the House and Senate versions of the general government spending bill that funds OPM call on that agency for …More

Revocable trusts, also known as living trusts, are increasingly popular. They can serve two main purposes: * Probate avoidance. Assets …More

Good News First: The average retirement savings numbers that we are going to look at is for all Americans, not …More

Some 53 million Americans are now providing support to family members both older and younger than they are, up more …More

If you are in good health and applying for a non-disability retirement, you are eligible to elect an insurable interest …More

A survey has found common themes in dreams for retirement among all four generations studied, but the same was not …More

Because planning ahead is a crucial step in assuring that your transition from employment to retirement is smooth, you need …More

A Social Security reform bill (HR-4583) newly introduced with nearly all House Democrats as cosponsors would eliminate the windfall elimination …More

If you leave the federal government before you are eligible to retire, you may be eligible for a deferred annuity. …More

You could live several decades or longer in retirement; how can you provide for income far into the future? Possible …More

We are halfway through the year. Has anything in your life significantly changed such as getting married, having a baby …More

When protecting against cognitive decline by designating someone to act on one’s behalf, timing is important but there are many …More

If you are married and approaching retirement, you’ll be facing decision of whether elect a survivor benefit for your spouse. …More

An inspector general report has recommended tightening the controls over settlements between OPM and federal retirees in cases of overpaid …More

“Special category” federal employees include law enforcement officers, firefighters, and air traffic controllers. If you fall into one of those …More

The GAO has cited the cost in added premiums for both the government and enrollees in the FEHB program in …More

A homeowner’s insurance policy should not be acquired when you buy your home and then forgotten. Here is how to …More

Many households underestimate their risk that their finances in retirement will be insufficient to maintain their standard of living, says …More

Social Security benefits differ in several ways from civil service retirement benefits, with one prominent difference being that while in …More

There are some big changes coming to Required Minimum Distributions (RMD) in 2023 and beyond. As is usual, Congress has …More

The share of workers “at risk” of not being able to maintain their standard of living in retirement has leveled …More

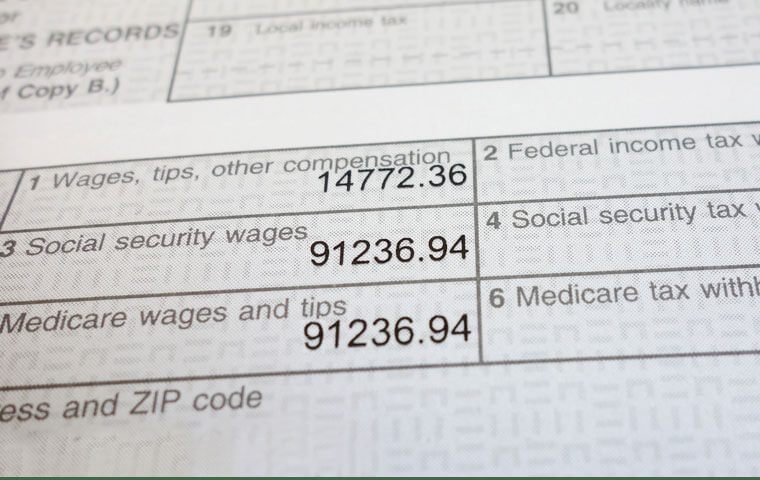

You want to make sure that all of your creditable service time counts in your retirement calculation. A first step …More

Increasingly, your credit score is being used for purposes other than approving loan requests. You score might be used to …More

A study examining options for shoring up the Social Security program’s finances says that an argument can be made for …More

If you have a cash value life insurance policy, you can borrow against it. This might be a source of …More

RMG put together a list of the most common mistakes we see federal employees make during the course of a …More

The latest annual “retirement confidence survey” found both workers and retirees feeling less sure they will have enough money to …More

In general, a deposit is the payment of the retirement deductions, plus interest, that would have been withheld from your …More

| TSP | L Income | L 2020 | L 2030 | L 2040 | L 2050 | G Fund | F Fund | C Fund | S Fund | I Fund |

|---|---|---|---|---|---|---|---|---|---|---|

| Sep | 1.18% | % | 2.14% | 2.50% | 2.79% | 0.35% | 1.09% | 3.65% | 2.04% | 3.16% |

| YTD | 7.50% | % | 12.39% | 14.15% | 15.61% | 3.34% | 6.14% | 14.80% | 11.18% | 25.34% |

| 10yr | 5.08% | % | 8.90% | 9.96% | 10.88% | 2.71% | 1.95% | 15.28% | 11.38% | 8.53% |