Most federal employees have a multiplier of 1% if they retire with a full retirement. But there are two ways to increase that multiplier. Image: Proxima Studio/Shutterstock.com

By: Dallen Haws

Most federal employees have a multiplier of 1% if they retire with a full retirement. But there are two ways to increase that multiplier. Image: Proxima Studio/Shutterstock.com

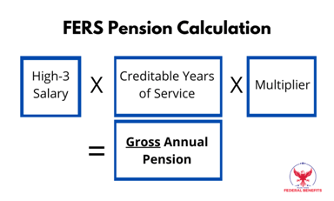

By: Dallen HawsThe FERS (Federal Employees Retirement System) pension calculation is based on three variables: your high-3 salary, years of service, and your multiplier. Here is how its calculated:

For Example: Let’s say you have 20 years of creditable service, a multiplier of 1% and a high-3 salary of $100,000. That would be $100,000 x 20 x 1% = $20,000 per year. This means that you will get a gross number of $1,666 (before taxes and deductions) every month in retirement from your pension.

Now let’s go over the 6 ways you can increase these three variables of the pension.

High-3 Salary

1. The first way you can increase your high-3 salary is to get a higher paying job/promotion. This isn’t always convenient. But, some people find that it is worth it to work a high-paying and high-stress job for 3 years just to increase their high-3 salary. This would make the most sense towards the end of your career when you are most likely paid the most.

2. The second method to increase your high-three salary is to move to somewhere with a high locality pay. Many people decide to move to somewhere like California for 3 years and then move back to their state or a cheaper state to live in when they retire. This strategy is also best done at the end of your career when you most likely have the highest salary.

Creditable Years of Service

3. The first and obvious solution to increase your years of service is just to work more. Some people get bored in retirement and want to keep working to stay busy. This solution isn’t the most practical for all people. Many federal employees are tired and ready for retirement.

4. The second way to increase your creditable years of service is to increase your sick leave. Unlike annual leave that can’t accrue past the maximum of every year, sick leave increases every year and there is no limit to how much you can have at retirement. Many federal employees avoid using sick leave so this could be a great option for them.

Just to clarify, although sick leave can increase your years of service when calculating your pension, it does not count towards your years of service or age when you want to qualify for retirement.

For example: If you retire at age 59 with 19 years of service and 1 year’s worth of unused sick leave, your pension calculation will use 20 years of service but it will not increase your years of service or age when qualifying for retirement.

Unused sick leave won’t increase your pension by a huge amount if you don’t have a lot of it. Basically, if you have 2,087 hours of unused sick leave, that would add another year of creditable years of service in your pension calculation.

Multiplier

Most federal employees have a multiplier of 1% if they retire with a full retirement. But there are two ways to increase that multiplier.

5. The first way to increase your multiplier is by working for at least 20 years and being at least 62 when you retire. Doing these two things will increase your multiplier from 1% to 1.1%. Thus, increasing your pension by 10% overall for the rest of your life. This is probably one of the easiest ways to increase your pension by a substantial amount.

6. The last way to increase your pension calculation is for anyone considering to work in a special provisions position in the government. This includes law Enforcement Officers, federal firefighters, air traffic controllers, and military reserve technicians. This is probably not convenient for anyone who is specialized and comfortable where they are in the government.

For special provisions, their first 20 years of service get a multiplier of 1.7%. That is a 70% increase! Any additional years of service have a multiplier of 1%.

Special provisions retire a little differently than traditional federal employees. They are expected to work less years, therefore their multiplier is increased.

Conclusion

These tips can be inconvenient for some feds while others are an easy adjustment that can make a huge difference. Some feds are just fine at retirement and making these adjustments isn’t worth it for them. The important thing to think about is how well you are overall at retirement.

The FERS pension is just one of many benefits as a federal employee. Make sure you think about your Thrift Savings Plan (TSP), your social security and any other income that you might have in retirement. Considering all these factors can give you a good idea on how your retirement will turn out.

Dallen Haws is a Financial Advisor who is dedicated to helping federal employees live their best life and plan an incredible retirement. He hosts a podcast and YouTube channel all about federal benefits and retirement. You can learn more about him at Haws Federal Advisors.

OPM Advises Agencies on Conducting RIFs During Shutdown

Updated Shutdown Contingency Plans Show Range of Impacts

Use Shutdown as Justification for More RIFs, OMB Tells Agencies

Unions Win a Round in Court Disputes over Anti-Representation Orders

Deferred Resignation Periods End for Many; Overall 12% Drop

Senate Bill Would Override Trump Orders against Unions

TSP Adds Detail to Upcoming Roth Conversion Feature

See also,

Legal: How to Challenge a Federal Reduction in Force (RIF) in 2025

How to Handle Taxes Owed on TSP Roth Conversions? Use a Ladder

The Best Ages for Federal Employees to Retire

Best States to Retire for Federal Retirees: 2025

Retention Standing, ‘Bump and Retreat’ and More: Report Outlines RIF Process