If you do not qualify for a full retirement, you cannot receive the FERS supplement. Image: Golden Dayz/Shutterstock.com

By: Dallen Haws

If you do not qualify for a full retirement, you cannot receive the FERS supplement. Image: Golden Dayz/Shutterstock.com

By: Dallen HawsFederal employees enjoy many benefits in retirement. Two great benefits are the FERS supplement and the 10% pension bonus.

However, it is impossible to get both of them as their eligibility rules make them mutually exclusive.

So if you can only get one of them, which one should you go for?

And the answer isn’t a simple one. In this article, we will dive into the pros and cons of each to give you a better understanding of which you would prefer.

We will start by looking at the FERS Supplement:

What is the FERS Supplement?

The FERS supplement is an additional payment that you can receive on top of your FERS pension before the age of 62 in retirement.

Your income could look like something like this if you get/qualify for the FERS supplement at age 57:

Who is Eligible for the FERS Supplement?

To get the FERS Supplement you have to retire with a full retirement before age 62. That means you have to hit one of the following:

● Be at least your MRA (minimum retirement age) with at least 30 years of service

● Or at least age 60 with 20 years of service.

If you have enough years of service to qualify but you retire after 62 then you do not get the FERS supplement because the supplement stops paying at 62.

If you do not qualify for a full retirement, you cannot receive the FERS supplement. Some federal employees retire with a postponed retirement, MRA + 10 retirement, or deferred retirement. None of these retirements are qualified to receive the FERS supplement.

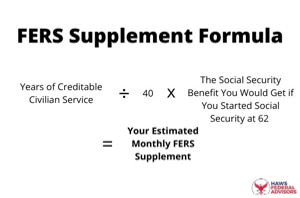

How is the FERS Supplement calculated?

The formula takes your years of creditable civilian service, divides it by 40 and then multiplies that by your age 62 Social Security benefits. This picture shows the formula.

[FERS Supplement calculator here]

If your goal is to have a FERS supplement that is the same as your full social security benefit at age 62, you would need to work at least 40 years. Most people have not worked for the federal government that long. Therefore, the FERS supplement is usually not as big as your social security benefit.

Now, let’s take a look at the 10% pension bonus:

What is the 10% Pension Bonus?

For traditional federal employees, the normal multiplier of the FERS pension is 1%. This multiplier is used by the federal government to calculate your FERS pension benefit. However, there is a way to increase the FERS pension to a 1.1% multiplier. This increase is called the 10% pension bonus.

Note: Special Provision employees have different multipliers and are not usually eligible for the 1.1% bonus.

Who is Eligible for the 10% Pension Bonus?

The 10% pension bonus is available to any federal employee with at least 20 years of service at the age of 62 or above. 20 years means at least 20 years of full-time service. If you’ve had several years of part-time service, these years are prorated depending on how many hours you worked in each year. For example: If you had 17 years of full-time service along with 6 years of part-time service working 20 hours a week, you will qualify for the 20 years requirement.

Is the 10% Pension Bonus Worth It?

This 10% increase will last for as long as your pension does (for the rest of your life). That can have a huge impact on your retirement. For example: If your FERS pension in retirement was $2,000 the 10% bonus would increase your pension to $2,200 each month. That’s an extra $200 every month for the rest of your life (and can increase your spouse’s survivor benefit for the rest of his or her life).

Which is Better?

This is the golden question. The FERS supplement is definitely a unique and helpful benefit in retirement. From month to month, it will be a bigger benefit than the 10% pension bonus. But, as we discussed, it will not continue past the age of 62. While, the 10% pension bonus will.

Example:

A standard FERS supplement benefit for a federal employee is around $1,000. And a standard FERS pension is around $2,000. Would you rather have $1,000 a month for the maximum of 5 years or would you rather have $200 a month from the minimum age of 62 until you pass away. This is a very simplified example. Your situation is probably very different. But, you can try to do the math and see what works best for you.

Conclusion

Being a federal employee has many benefits. But, it can be difficult to know or even take advantage of all the benefits. There’s so many nuances that you have to consider. Hopefully this article helped a little!

Dallen Haws is a Financial Advisor who is dedicated to helping federal employees live their best life and plan an incredible retirement. He hosts a podcast and YouTube channel all about federal benefits and retirement. You can learn more about him at Haws Federal Advisors.

Deferred Resignation Periods about to End for Many; Overall 12% Drop

Retirement Surge Likely as Deferred Resignation Periods End

Senate Rejects Bills to Defer Shutdown; Familiar Process Lies Just Ahead

Senate Bill Would Override Trump Orders against Unions

Report Describes Impact of Shutdown on Employees, Agencies

TSP Adds Detail to Upcoming Roth Conversion Feature

See also,

Legal: How to Challenge a Federal Reduction in Force (RIF) in 2025

How to Handle Taxes Owed on TSP Roth Conversions? Use a Ladder

The Best Ages for Federal Employees to Retire

Best States to Retire for Federal Retirees: 2025

Retention Standing, ‘Bump and Retreat’ and More: Report Outlines RIF Process