Early retirement can be a great way to get out and move to a different phase of your life. Image: SvetaZi/Shutterstock.com

By: Dallen Haws

Early retirement can be a great way to get out and move to a different phase of your life. Image: SvetaZi/Shutterstock.com

By: Dallen HawsFederal employees have great retirement benefits but most are only eligible for these benefits after decades of working.

But is there a way to retire early and still get great benefits?

Yep!

But the devil is in the details.

What is Early?

For us to know what early retirement is we have to know what normal retirement looks like.

To qualify for a ‘normal’ full retirement as a traditional FERS, you have to qualify for one of these:

● Hit your MRA (minimum retirement age)* with at least 30 years of service

● Age 60 or later with at least 20 years of service

● Age 62 or later with at least 5 years of service

*Your minimum retirement age is based on your birth year and for most people it is between age 56 and 57.

If you are a special provision employee (air traffic controller, firefighter, law enforcement) then the normal retirement rules are different for you:

● Age 50 with 20 years of special provision service

● Any Age with 25 years of special provision service

If you are special provision then I have bad news. There is no way to retire with less than 20 or 25 years and get a special provision retirement. I guess the government figures that a normal special provision retirement is an early retirement compared to everyone else.

However, if you have less than the 20 years needed for a special provision retirement and you move to a traditional FERS position then you’d fall under the traditional FERS retirement rules.

Three Early Options

There are 3 main options to retire early but they are not created equal.

Here they are:

MRA+10 Retirement

VERA (Early Out)

Deferred Retirement

Each one of these early retirement options come with different benefits and drawbacks.

MRA+10

As the name suggests, to qualify for this type of retirement you have to hit your MRA (minimum retirement age) and have at least 10 years of service.

For example, if you are 58 with 14 years of service then you’d qualify.

Benefit:

You can retire early.

Drawback:

For every year you retire (with this type of retirement) before age 62 then your pension is reduced by 5%. So if you retire at 58 with 14 years of service then your pension would be reduced by 20% since you retired 4 years before 62.

Workaround:

The only way to not get this pension reduction is to either work until you are eligible for a full retirement retirement or choose to take a postponed retirement.

A postponed retirement is when you take a MRA+10 retirement but postpone your pension to avoid the pension reduction. If you have less than 20 years of service you’d have to postpone until age 62 to avoid all reductions. If you have more than 20 years then you’d have to postpone it until age 60.

And while your pension is postponed you won’t have the government insurance (health insurance, life insurance, or dental/vision insurance). But you can restart the insurance once your pension starts.

So in practice this is what it would look like:

● You’d retire under MRA+10 retirement but then postpone your pension until 60 or 62 depending on your years of service.

● You won’t get a pension during the gap and you won’t have government insurance during the gap.

A postponed retirement is used in all sorts of situations but the most common I see is when someone wants to go take a private sector job as that job would provide them income and insurance to fill the pension/insurance gap.

VERA (Early Out)

A VERA (Voluntary Early Retirement Authority) is a great way to retire early but it is not available to everyone all the time.

It only happens when your agency is trying to downsize (get people off the payroll). Here are the major steps that have to happen:

● Your agency applies and is approved by OPM to offer a VERA

● Your agency offers an early out for your position

● You apply and are approved for the early out by your agency

If any of these steps don’t happen then a VERA is not available to you.

Who is Eligible for FERS Early Out Retirement?

To be eligible to apply for a VERA you have to hit one of the following:

● Have at least 20 years of service and be at least age 50 or

● Have at least 25 years of service at any age

If you meet one of these requirements then you are eligible to apply for the VERA and then your agency would have to accept your application.

What Benefits Come with a VERA?

With a VERA you get a pension right away with no reductions. You are also able to keep your insurance into retirement.

Benefit:

You are able to retire early with all your normal benefits

Drawback:

Your FERS Supplement wouldn’t start until your MRA and your pension may be smaller simply because you left with fewer years of service than you’d have if you worked until normal retirement.

Deferred Retirement

This is the least attractive type of retirement but the easiest to qualify for. And technically, while it is called a deferred retirement, it is simply resigning before you are eligible for any other type of retirement.

To qualify, all you need is 5 years of service at any age.

And as the name suggests, you retire and your pension is deferred until later.

Note: Don’t get this confused with the postponed retirement then we discussed in the MRA+10 section. Postponed and deferred retirements are two completely different things in the FERS retirement world.

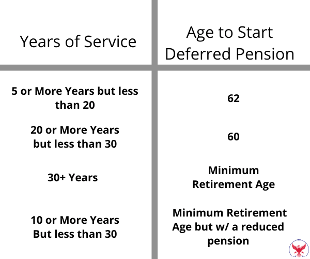

And when you can start your deferred pension will depend on how many years of service you left with per this chart:

Benefit:

You can get a pension even though you weren’t eligible for a full retirement.

Drawback:

You can’t keep any of your other benefits like health insurance, life insurance, and dental/vision insurance and they can’t be restarted once your pension starts.

Note: You can keep your Long Term Care insurance if you had it before you took a deferred retirement.

Final Thoughts

Early retirement can be a great way to get out and move to a different phase of your life.

However, every type of retirement has its pros and cons.

The most important thing is that you find the mixture of pros and cons that you can live with.

Agency RIFs, Reorganizations Starting to Take Shape

Order Formally Launches ‘Schedule Policy/Career,’ Adds Category of Appointees

Top 10 Provisions in the Big Beautiful Bill of Interest to Federal Employees

A Pre-RIF Checklist for Every Federal Employee, From a Federal Employment Attorney

Work Longer or Take the FERS Supplement Now: Which is Better?

See also

Alternative Federal Retirement Options; With Chart

Primer: Early out, buyout, reduction in force (RIF)

Retention Standing, ‘Bump and Retreat’ and More: Report Outlines RIF Process