There is very little that helps more than having wiggle in retirement numbers. Image: Sai Jirawadee/Shutterstock.com

By: Dallen Haws

There is very little that helps more than having wiggle in retirement numbers. Image: Sai Jirawadee/Shutterstock.com

By: Dallen HawsWhat keeps you up at night?

Well if you are an average American then it is probably the fear of public speaking or running out of money before you die.

No one wants to have to clock in somewhere they’d rather not be during retirement just to make ends meet.

But I have good news.

As a federal employee you have lots of ways to ensure your money doesn’t croak before you do.

Strong Foundation

Federal employees are starting way ahead of most people when it comes to retirement.

FERS federal employees get social security and a pension. Both of which get COLAs (cost of living adjustments).

This means that as prices increase with inflation your social security and pension go up too.

So even if you had no investments (TSP, IRA, etc) you’d have a strong baseline of inflation-protected income for the rest of your life.

This is a great place to start.

Diet* COLA

Social security gets a full COLA while your FERS pension gets a “diet-cola”.

This means that if inflation is 5% then your social security will increase by 5%. However, your FERS pension will only increase by 4%. It sometimes lags behind inflation by a little bit.

Here is how it works:

If inflation is 3% or more, FERS COLAs will lag by 1%. If inflation is between 2%-3% then FERS retirees only receive a 2% increase. When inflation is under 2% then the COLA will match inflation perfectly.

Summary: Your FERS pension will lag inflation by a little bit when inflation is above 2%.

Good, Not Great

Having 2 fixed income sources (social security and pension) is good but you are not out of the woods yet.

If you want a great retirement (not just a good one) then you are going to need investments that ensure you have the retirement lifestyle you want now and for the rest of your life.

And whether or not your TSP lasts your entire life is not up to the government. It is up to you!

But here is a strategy to help you make sure your money will last and keep up with inflation.

4% Rule

The 4% rule is a simple strategy to know how much you can withdraw every year without worrying about running out of money.

The 4% rule says that you can withdraw 4% of your investment balance in the 1st year of retirement. In year 2 and beyond you can withdraw what you withdrew the year before plus whatever inflation was during the previous year.

Here is an example to see this in practice:

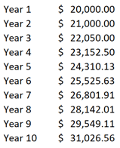

Let’s say you have 500k in your TSP. 4% of 500k is 20k.

So the 4% rule says you can withdraw 20k in year one. In year two you can withdraw 20k again plus whatever inflation was. So if inflation was 5% then you’d withdraw a total of 21k in year two.

And if we assume inflation is 5% every year for the first 10 years of your retirement then your withdrawals would look like this:

And again, if we follow the 4% rule then the odds of us running out of money in retirement is very small.

Note: The 4% rule assumes that you are invested at least 50% in stocks with the remaining part of your money invested in bonds. If you are 100% in the G fund then the 4% rule may not work for you.

The Best Strategy

I like the 4% rule a lot because it is simple and easy to understand.

This way it will be easy to implement overtime.

However, in my experience there is very little that helps more than having wiggle in retirement numbers.

If you have just enough retirement income to get by in retirement then things are going to be stressful.

And having some margin in your retirement income simply feels way more secure than living pension check to pension check.

And in retirement, just like life, there will always be unexpected emergencies/circumstances that are going to cost money to resolve.

Having a good comfortable retirement comes down to preparing and planning well so that you aren’t blind sided when something unexpected comes up.

Dallen Haws is a Financial Advisor who is dedicated to helping federal employees live their best life and plan an incredible retirement. He hosts a podcast and YouTube channel all about federal benefits and retirement. You can learn more about him at Haws Federal Advisors.

Shutdown Meter Ticking Up a Bit

Judge Backs Suit against Firings of Probationers, but Won’t Order Reinstatements

Focus Turns to Senate on Effort to Block Trump Order against Unions

TSP Adds Detail to Upcoming Roth Conversion Feature

White House to Issue Rules on RIF, Disciplinary Policy Changes

Hill Dems Question OPM on PSHB Program After IG Slams Readiness

See also,

Legal: How to Challenge a Federal Reduction in Force (RIF) in 2025

The Best Ages for Federal Employees to Retire

Alternative Federal Retirement Options; With Chart

Primer: Early out, buyout, reduction in force (RIF)

Retention Standing, ‘Bump and Retreat’ and More: Report Outlines RIF Process