June was a mixed month for the TSP: The G Fund was up a fraction of a percent for the month, while the F Fund was down a fraction of a percent due to interest rate sensitivity. The C Fund was up 0.6%, the S Fund was up 0.8%, and the I Fund was down 1.2%.

Bank Stocks Are Having a Rough Time

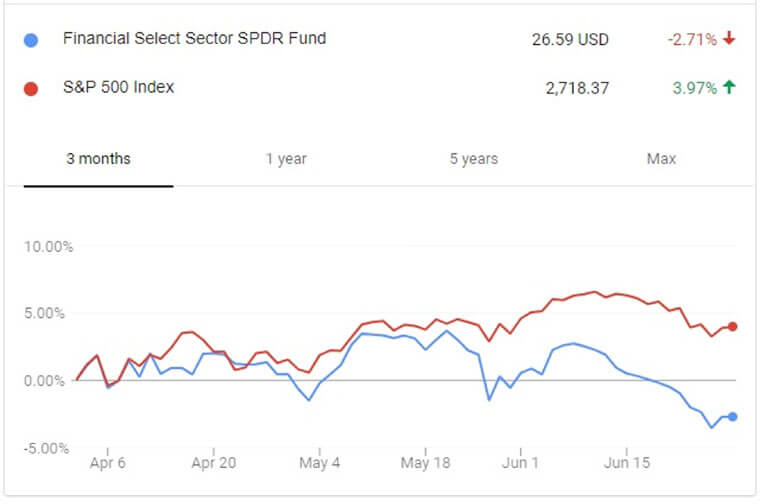

Until the middle of last week, the U.S. financial sector had a 13-day streak of lower share prices, which is its longest daily losing streak in history. Over the past three months in general, financials have underperformed the broader market by over 6.6%:

Since financials are the third largest sector in the S&P 500 and the C Fund that tracks it, this weak performance has dragged down total returns.

There are a number of things that can cause financial stocks to underperform, and the flattening yield curve is one of them.

Usually, longer-term bonds and debt pay higher interest rates than shorter term bonds and debt, because they have more risk. The yield curve is the difference between long term rates and short term rates, and is measured a few different ways.

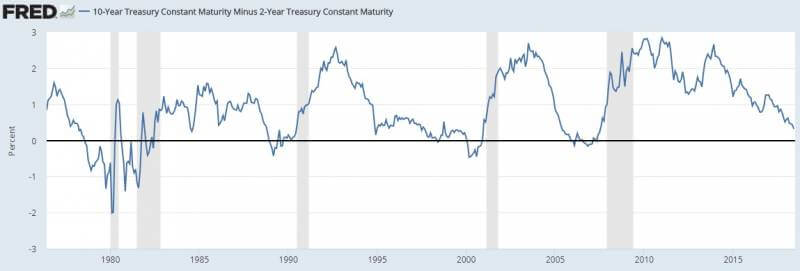

Every recession since World War II has been preceded by the yield curve inverting, meaning that short-term debt briefly pays higher interest rates than long term debt. On the following yield curve chart, recessions are in gray, and you can click the image for a bigger view:

The bad news about that chart is that the yield curve is getting close to inverting, which is a strong recession indicator. The good news is that a recession usually takes about a year or more to occur after the yield curve inverts, meaning that as long as the yield curve remains positive, it means a recession has historically not been very close.

But in the meantime, this isn’t great for banks. Banks make money by borrowing at low interest rates with short durations (like savings accounts), and lending money at higher rates with longer durations (like mortgages and personal loans). So, while they prefer higher interest rates in general, they don’t do as well when the difference between longer-term debt and shorter-term debt flattens or inverts. And when it does invert, banks have less incentive to lend money, which can reduce market liquidity and help cause recessions.

2018 Federal Reserve Stress Tests Results Released

What broke the 13-day losing streak for U.S. financial stocks was that the Federal Reserve approved capital return plans of most major banks on June 28th. This gave bank stocks a boost late last week.

Due to the Dodd-Frank Act that was passed after the previous decade’s financial crisis, the Federal Reserve does annual stress tests on major U.S. banks to see if they would remain comfortably solvent in the event of a major recession. They simulate a bad scenario in which stock markets fall well over 50%, housing prices crash over 30%, the country’s GDP contracts by over 7%, and unemployment rises to 10%, and then they calculate whether major banks will fall below their required capital reserve ratios under such troubling economic conditions.

Banks that pass the test are allowed to give higher dividends and stock buybacks to their shareholders, while banks that fail the test are required to increase their capital reserves before giving out more money.

The only bank that seriously failed this year’s test was the U.S. portion of Deutsche Bank, and it has failed some prior annual tests as well. Deutsche Bank is one of the largest lenders in Europe, and makes up a small fraction of the I Fund.

Two U.S. banks, Goldman Sachs and Morgan Stanley, also partially failed, but only due to one-time accounting issues related to the recent U.S. corporate tax cut. They are not allowed to raise their dividends and buybacks as much as they hoped this year, but weren’t found to have any structural deficiencies like Deutsche Bank. State Street Corporation and Capital One also had some modest issues, but not serious deficiencies.

All other large banks passed with flying colors, and most of them announced plans to raise their dividends and share buybacks considerably. This means higher dividend yields and faster earnings-per-share growth. As a result, most bank stocks did very well late last week. Other concerns aside, this is positive news going forward for banks and for the C Fund in general.

Lyn Alden is a financial writer and an engineer, and holds a bachelor’s in engineering and a master’s in engineering management, with a focus on financial modeling and resource management. She specializes in analyzing and presenting financial data. Her investment work can be found on LynAlden.com.