Image: Moab Republic/Shutterstock.com

By: Lyn Alden

Image: Moab Republic/Shutterstock.com

By: Lyn AldenThe Dow Jones Industrial Average had an eight-day losing streak that only ended last Friday due to a bump in energy stocks. Over the past two weeks, the C Fund is down about 1%, the S Fund is up about 0.2%, and the I Fund is down about 2%. Meanwhile, rising U.S. interest rates are putting some downward pressure on stock valuations, but it was renewed concerns by investors over trade wars that resulted in this period’s choppy performance. Takeway: It’s good to be diversified.

Higher Global Tariffs?

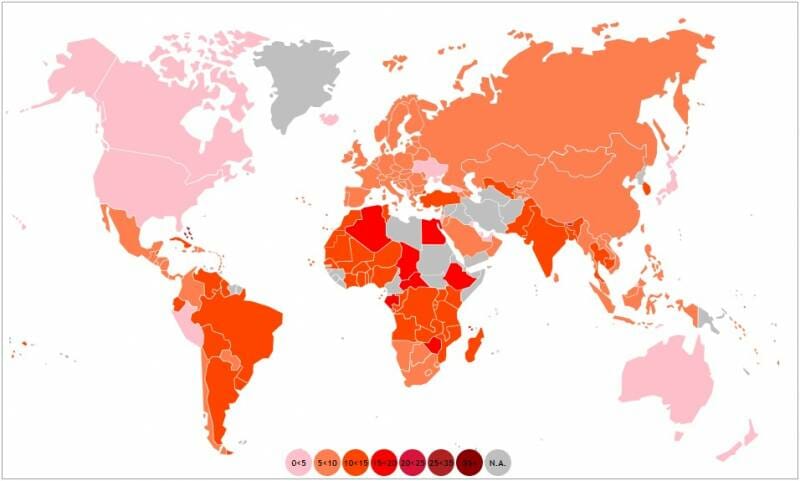

Historically and currently, the U.S. generally has lower import tariff rates than much of the rest of the world:

Source: World Trade Organization

That’s why there’s a good case to be made for evening this arrangement out.

As the U.S. threatens to increase tariff rates, there are a variety of outcomes that could occur. The most obvious possibilities are:

-Other countries could agree to lower some of their tariffs to more closely match low U.S. tariffs, so that U.S. tariffs remain low. This would make U.S. products more competitive globally.

-Other countries could retaliate by raising tariffs even higher, resulting in higher tariffs in both directions, increased protectionism, and lower global trade.

The Trump administration recently announced plans to impose tariffs on an additional $200 billion in Chinese goods, and has floated the idea of imposing a 20%-25% tariff on European car imports. Currently, the U.S. taxes European cars at 2.5% and European trucks at 25%, while the European Union taxes U.S. cars at 10%.

As countries seem to take the second option of higher retaliatory tariffs, markets are expected to have volatility. Some of the biggest U.S. companies, like Apple, Boeing, and Caterpillar, get a significant share of their revenue from China and other countries, which is risky for them in the face of possible trade wars.

On the other hand, many smaller companies have less exposure to international markets, meaning tariffs don’t necessarily impact them as much. That may be why the S Fund has outperformed the C Fund this period.

OPEC Agrees on Mild Oil Production Increase

Energy stocks had a solid gain on Friday because OPEC announced a decision to mildly increase oil production. This alleviated investor uncertainty and fears that OPEC might dramatically substantially production, which would be a negative for energy stocks.

Here’s a chart of the price of oil over the past 18 months, showing a large price increase as demand began to outpace supply:

Source: Nasdaq

All else being equal, this decision from OPEC should help stabilize or even reduce oil prices a bit, which will help consumers and businesses out in the summer when oil prices tend to be high.

Unusually high oil prices are a potential catalyst to slow down an economy and trigger a recession, so this decision to mildly alleviate rising prices reduces that possibility.

Lyn Alden is a financial writer and an engineer, and holds a bachelor’s in engineering and a master’s in engineering management, with a focus on financial modeling and resource management. She specializes in analyzing and presenting financial data. Her investment work can be found on LynAlden.com.