The “old” I Fund index included 21 developed countries and zero (0) emerging market countries, while the “new” I Fund index will include 21 developed countries and 23 emerging market countries. Image: RomanR/Shutterstock.com

By: Scott Swisher, TSP Change Alerts

The “old” I Fund index included 21 developed countries and zero (0) emerging market countries, while the “new” I Fund index will include 21 developed countries and 23 emerging market countries. Image: RomanR/Shutterstock.com

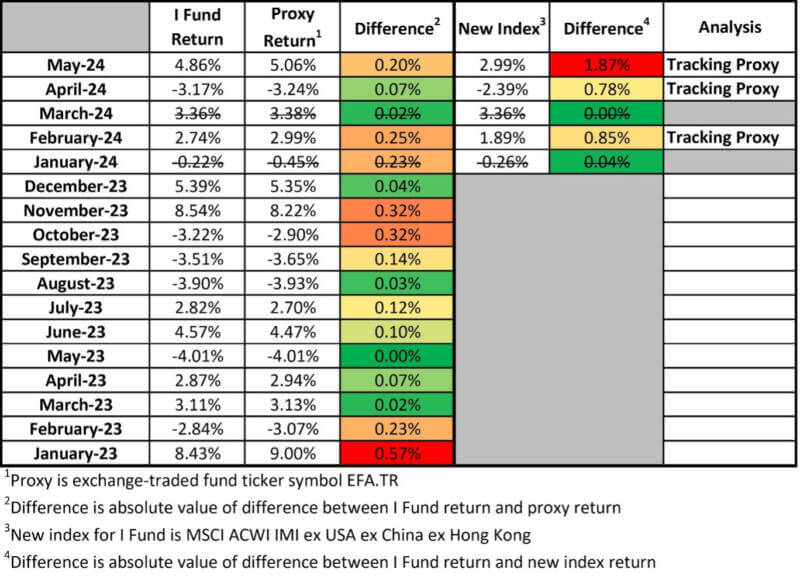

By: Scott Swisher, TSP Change AlertsThankfully, the I Fund’s index through the end of May 2024 hasn’t changed much. How do I know? Last month, May 2024, the I Fund returned 4.86%, much closer to the proxy of its old index (5.06%) than the index it will track by the end of 2024 (2.99%).

Why does this matter? As I articulated in an article earlier this year, once completed, this change in the I Fund’s underlying index should be expected in aggregate over the long term to cost TSP participants money. How much money? Well let’s just look at the year-to-date returns through May 2024. The I Fund has returned 7.59%, while the index the I Fund will track by the end of 2024 has returned only 5.60%. So let’s assume you have a $100,000 TSP investment account and are investing in the L2050 Fund which automatically places 28.5% or $28,500 of your $100,000 account into the I Fund. Year-to-date if the transition to the new I Fund index had already been completed, this change would have already cost you nearly $570 in performance on your $100,000 account! Even worse, what will it cost you in the years or even decades to come?

Let’s back up. The TSP’s I Fund, or International Stock Index Investment Fund, is in the process of switching its index, to be completed no later than the end of 2024. An index is simply a term used to indicate what a fund is attempting to mirror. In this case, the I Fund will no longer mirror the MSCI EAFE index, but will move to mirror the MSCI ACWI IMI ex USA ex China ex Hong Kong index.

The “old” I Fund index included 21 developed countries and zero (0) emerging market countries, while the “new” I Fund index will include 21 developed countries and 23 emerging market countries.

There are no major funds, be them mutual funds or exchange-traded funds, following the MSCI ACWI IMI ex USA ex China ex Hong Kong index. And there is a reason for this, there simply isn’t any demand outside of the TSP for such an arcane fund. Moreover, I called my large and well-known financial data provider, and they told me they couldn’t even provide me with a data feed to track the daily performance of this index. If you read the fine print of the new I fund index, you see it was established in June 2023. I’m guessing this was at the request of the Federal Retirement Thrift Investment Board (FRTIB)—the entity responsible for administering the TSP.

Why would anyone pay this much attention to the index the TSP’s I Fund is tracking? My company uses thousands of daily price comparisons to determine the health of the financial markets. It’s like getting your blood tested at your doctor’s appointment! The I Fund is directly involved in four of these price comparisons. If I’m not using the correct index or proxy to conduct these price comparisons, I am doing a disservice to my subscribers.

The change in the I Fund’s underlying index will unfortunately adversely affect all but only a very small percentage of TSP participants. Are you prepared for this change?

Scott Swisher helps federal government employees better manage risk where they hold their largest amount of investment account assets, in their TSP accounts. He is owner of TSP Change Alerts, a company providing TSP tactical reallocation services to individual federal government employees. Scott can be reached at scott@tspchangealerts.com.

Shutdown Meter Ticking Up a Bit

Judge Backs Suit against Firings of Probationers, but Won’t Order Reinstatements

Focus Turns to Senate on Effort to Block Trump Order against Unions

TSP Adds Detail to Upcoming Roth Conversion Feature

White House to Issue Rules on RIF, Disciplinary Policy Changes

Hill Dems Question OPM on PSHB Program After IG Slams Readiness

See also,

Legal: How to Challenge a Federal Reduction in Force (RIF) in 2025

The Best Ages for Federal Employees to Retire

Alternative Federal Retirement Options; With Chart

Primer: Early out, buyout, reduction in force (RIF)

Retention Standing, ‘Bump and Retreat’ and More: Report Outlines RIF Process