It is a retirement killer to withdraw money from the C fund when the stock market is down. Image: Pierre Desrosiers/Shutterstock.com

By: Dallen Haws

It is a retirement killer to withdraw money from the C fund when the stock market is down. Image: Pierre Desrosiers/Shutterstock.com

By: Dallen HawsFederal employees enjoy various benefits. One benefit most federal employees rely on in retirement is the TSP (Thrift Savings Plan). Unlike an IRA (individual retirement account), the TSP allows federal employees to receive employer matching contributions. Another major difference between IRA and TSP is simplicity. In an IRA, you can invest in almost anything. But, the TSP has very few options comparatively – outside the Mutual Fund window, which allows for outside investments, albeit with certain restrictions and fees.

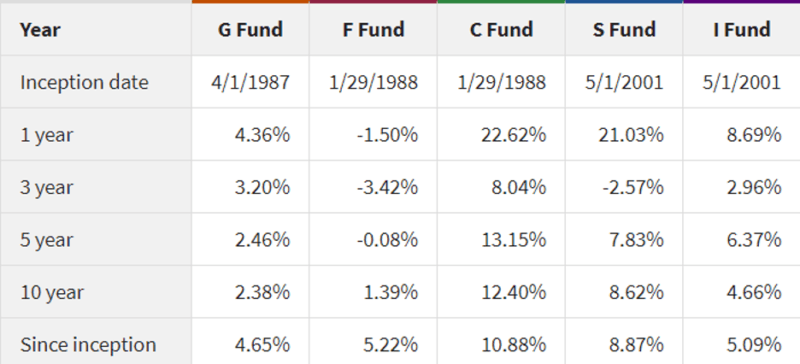

The TSP is composed of five basic funds (G, F, C, S, & I funds) along with 10 different L funds that are combinations of the five basic funds. In this article we will be mainly discussing the C fund. The C fund is known as one of the more aggressive TSP funds. In the short term it is very volatile, but in the long term it has proved to get high returns. Let’s take a look at the returns of the five basic funds over time:

Benefits of the C Fund?

As we see from the returns over time, the C fund has a very high long-term return. Since its inception, the C fund has made an average annual return of 10.88%. That means if you put $1,000 in the C fund for the next 10 years, you would have about $2,809 (using the 10.88% return). Whereas, if you invested $1,000 in the G fund for the last 10 years, you would have about $1,575. That’s a big difference. Note: the C Fund return is not guaranteed.

If you are early in your career, being in aggressive funds like the C fund can be a great plan. Considering you won’t retire or use the TSP funds for many years, your greatest friend is growth. You want to be able to beat inflation over time and have a nice nest egg for yourself when you retire. Keep in mind that the S and I Fund are also volatile funds that can also provide growth over time.

What is the C Fund?

In an IRA you have the ability to invest in individual stocks/companies. Investing your retirement money in individual stocks or companies can be very dangerous as you depend on that one company to make money for you. If the company does great, you’ll do great. BUT, you also have a greater risk of losing all of your money.

In contrast, the C fund matches the S&P 500 index. This is the 500 largest companies in the United States. The C fund is not just invested in one company. If one of the companies in the S&P 500 goes into bankruptcy, you probably won’t notice as much of a difference.

Downsides to the C Fund

There can be a danger in investing in the C Fund. Afterall, the return is not guaranteed.

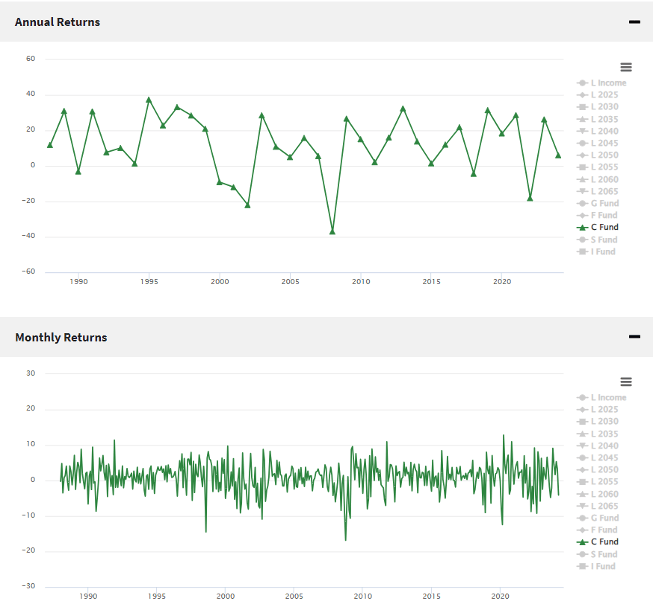

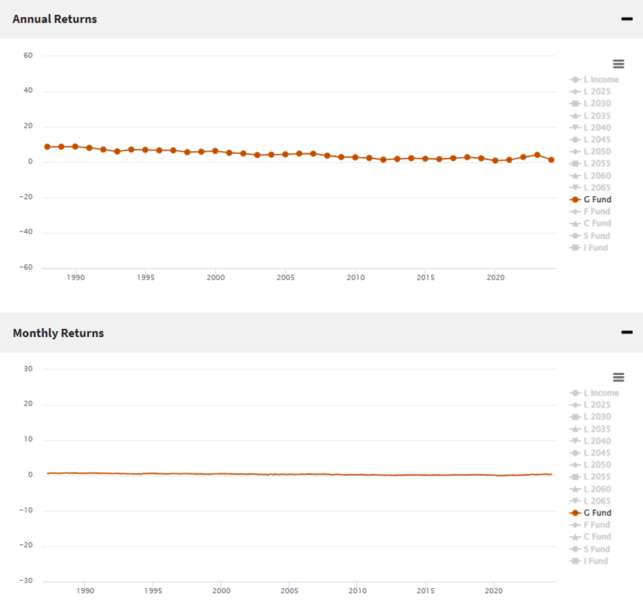

See how much the C fund fluctuates. If you are looking for a consistent and secure return on money, the C fund is not a great investment. Federal employees that are close to retirement and planning to use the TSP soon may not want to invest completely into the C Fund. As you approach retirement, it’s a good idea to have some money that is secure. Let’s take a look at the annual and monthly returns of the G fund (which is known as the most conservative fund in the TSP):

The G fund return is very consistent over time. As long as the federal government remains intact, the G fund will continue to give consistent and positive returns. As you approach retirement or plan to use the TSP money, it is a good idea to have some money invested in funds like the G Fund that won’t lose value in the short-term. If you want to see this more in depth, check out this video.

When is 100% in the C Fund Good?

Most federal employees never put 100% of their retirement money into the C fund. If they are just starting out in their career, having most of your funds into the C, S, and I funds is a good idea. And sure, 100% in the C fund will probably be fine as well in your early career but, it’s also nice having more than just the top 500 companies in your portfolio.

If you are approaching retirement and are planning to take withdrawals from your TSP soon, 100% in the C fund is almost never a good idea. As we saw from the graphs, the C fund is very volatile and very difficult to predict in the short term. It is a retirement killer to withdraw money from the C fund when the stock market is down.

Conclusion

Hopefully this gave you a greater understanding of what the C fund is all about. The C fund has its strengths and weaknesses. Make sure you align your financial goals with how you invest your money during your career and into retirement. We wish you the best of luck and hope you have a great career / retirement.

Dallen Haws is a Financial Advisor who is dedicated to helping federal employees live their best life and plan an incredible retirement. He hosts a podcast and YouTube channel all about federal benefits and retirement. You can learn more about him at Haws Federal Advisors.

Shutdown Meter Ticking Up a Bit

Judge Backs Suit against Firings of Probationers, but Won’t Order Reinstatements

Focus Turns to Senate on Effort to Block Trump Order against Unions

TSP Adds Detail to Upcoming Roth Conversion Feature

White House to Issue Rules on RIF, Disciplinary Policy Changes

Hill Dems Question OPM on PSHB Program After IG Slams Readiness

See also,

Legal: How to Challenge a Federal Reduction in Force (RIF) in 2025

The Best Ages for Federal Employees to Retire

Alternative Federal Retirement Options; With Chart

Primer: Early out, buyout, reduction in force (RIF)

Retention Standing, ‘Bump and Retreat’ and More: Report Outlines RIF Process