Earlier this month, Apple became the first U.S. company in history to surpass $1 trillion in market capitalization:

Chart Source: Google Finance

The market capitalization of a company is the price of the stock multiplied by the number of shares in existence. In other words, it’s roughly the price it would take to buy 100% of the stock.

After many years of increasing profits, and a steadily rising stock price, the total value of Apple is now worth north of $1 trillion. There are over 5 billion Apple shares in existence, with each share being priced over $200 right now by the market. It’s the largest component in the TSP’s C Fund, currently accounting for about 4.2% of the 500-company fund.

Taking a more global perspective, Apple is only the second publicly-traded company worldwide to have reached the $1 trillion mark. PetroChina, China’s state-controlled oil company, briefly became the first trillion-dollar business in the world when it became a public company in 2007.

However, the only reason PetroChina reached such a lofty height was that it was dramatically overvalued, trading at about 60 times its net income. By 2008, it had dropped down to about $250 billion in market capitalization, and has never recovered anywhere near $1 trillion, since it never had anywhere near the business fundamentals to justify such a high valuation.

Apple, on the other hand, reached $1 trillion fair and square. The company made $56 billion dollars in net income over the past 12 months, and its price-to-earnings ratio is less than 20.

The average price-to-earnings ratio of all companies in the C Fund is currently over 24, which means based on that metric, Apple is trading at a mildly below average valuation. Investors seem to have a realistic view of the company- that worldwide phone sales may be saturated, but that the company has large growth potential in its services segment, as it gets a share of the growing amount of apps and media on its device network.

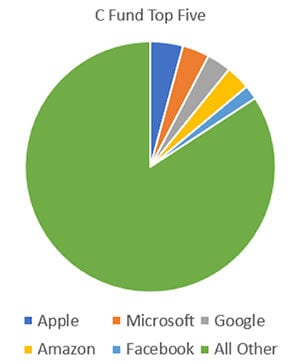

The C Fund Top Five

The top five largest components of the C Fund, collectively accounting for a whopping 15% of the 500-company C Fund, are all technology companies. These five are Apple, Microsoft, Google, Amazon, and Facebook. The reason that so few companies account for such a large chunk of the fund, is that the C Fund is weighted by market capitalization. The fund has the most money invested in the biggest companies.

Chart Source: Lyn Alden, data from Blackrock

Amazon currently has a market capitalization of over $900 billion. Microsoft’s and Google’s market capitalizations are both over $800 billion, and Facebook’s is over $500 billion. Several of these companies are within striking distance of joining Apple over the $1 trillion line. And all of them are trading at higher price-to-earnings ratios than Apple. While Apple’s ratio is under 20, Facebook’s is over 24, Microsoft’s is over 27, Google’s is over 33, and Amazon’s is over 150.

Lyn Alden is a financial writer and an engineer, and holds a bachelor’s in engineering and a master’s in engineering management, with a focus on financial modeling and resource management. She specializes in analyzing and presenting financial data. Her investment work can be found on LynAlden.com.