College Savings Shouldn’t Start and End with 529 Plans

When you’re saving for your children’s college education, 529 plans offer some outstanding tax advantages. Investment buildup is tax-free and …More

When you’re saving for your children’s college education, 529 plans offer some outstanding tax advantages. Investment buildup is tax-free and …More

OPM has revised guidance first issued a decade ago on what federal employees can do to make their retirement applications …More

If you are 60 or older, there is no restriction on the amount of income you can earn while receiving …More

To determine whether you should use trusts, you need to understand what they are. A trust is a paper entity …More

Sources of income change in retirement change over time although at every point Social Security is a major consideration, for …More

Periods of active duty military service can be added to your civilian service but it needs to be handled with …More

One option in retirement is to sell your house to a grown son or daughter, then rent the house from …More

Problems with federal employees being enrolled in the wrong retirement system continue to arise when those employees apply for retirement, …More

After you submit your federal retirement application, your personnel office will finish the processing and forward the package to your …More

If you have an ample IRA(s), ongoing tax deferral can enrich your heirs. Poor planning, though, may rob your beneficiaries …More

Some parts of a package of changes to retirement savings programs including the TSP will take effect as soon as …More

One of the more difficult choices that federal employees face as they move into retirement is whether to provide for …More

If you decide you want to make lifetime gifts to your kids, what should you give away? Here’s one recommended …More

While the pandemic did not change the retirement plans of most women, those who said there was such an impact …More

Under both CSRS and FERS, disability benefits are payable if you have become so disabled that you are prevented from …More

If your parents or other relatives are getting to the stage where they can’t handle their affairs as well as …More

The high cost of housing in some areas of the country, particularly in major city areas, effectively makes retirement benefits …More

A nationwide survey has found that employer-sponsored health insurance and retirement savings plans are the most important factors in their …More

You may assign your Federal Employees Group Life Insurance to one or more persons, firms or trusts. Assignment means that …More

The effort to soften or repeal two reductions in benefits applying under the federal CSRS retirement system—the windfall elimination provision …More

Although most federal employees are eligible to carry FEHB coverage into retirement and most of them do, there are situations …More

How much life insurance coverage do you need? Rather than follow a pre-set formula, you should evaluate your personal situation …More

Of financial decisions, those related to retirement were among those where the deciding person has the least level of confidence, …More

A decision on when to retire can be guided in part by some common-sense principles regarding when you should not …More

The most recent two economic recessions had differing impacts on rates of retirement, with little change seen from the 2020 …More

Have you ever gotten into an argument with your health benefit plan over whether a medical procedure or service should …More

One reason for having a will is to make sure your wishes are carried out. If you die “intestate” (without …More

While phone calls remain the most common ways scammers target older persons, the percentage of those age 60 and older …More

Having sick leave not only helps when you are ill but can also be used for such things as childbirth, …More

The turn of the year is a natural, and good, time to get your financial records in order. Properly organizing—and …More

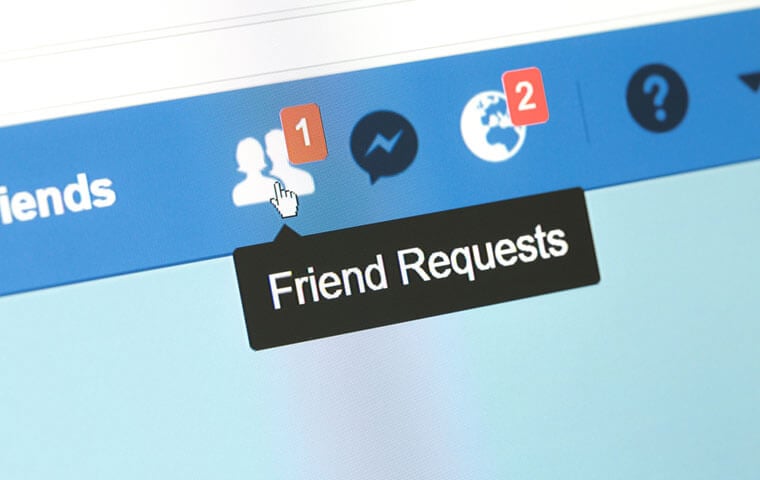

| TSP | L Income | L 2020 | L 2030 | L 2040 | L 2050 | G Fund | F Fund | C Fund | S Fund | I Fund |

|---|---|---|---|---|---|---|---|---|---|---|

| Aug | 1.12% | % | 1.97% | 2.29% | 2.55% | 0.37% | 1.19% | 2.03% | 4.08% | 3.95% |

| YTD | 6.24% | % | 10.04% | 11.37% | 12.47% | 2.98% | 4.99% | 10.76% | 8.96% | 21.50% |

| 10yr | 4.91% | % | 8.42% | 9.40% | 10.23% | 2.69% | 1.92% | 14.58% | 10.61% | 7.63% |